Can investors allocate to impact solutions within private credit? – RM Funds, April 2022

How can a lender who does not own the equity within portfolio investments make impactful investments? This is often asked by allocators, and is probably the main reason why so many investors and other stakeholders are keen to speak with RM Funds on the subject of our approach to impact lending. In truth, we had not initially planned to specifically target impact investing – however, we recognized our investments, borrowers and sector allocations had natural alignment with how RM started to view impact investing during 2021. As we moved deeper into drilling down on our thoughts as to how one could allocate, measure and report back to investors on the impact their capital has made on people and the planet, it has become clear to us at RM on how this can be achieved.

We can break our thoughts down into 3 key themes;

- Size

- Sectors

- Sustainability

Size; our focus is on loans that are of non-benchmark size (we would categorize this as less then £25m). This is important as we believe there is a structural characteristic to the market where lenders have not allocated to companies of an intermediate size, whom we label as the “missing middle”. We take this further in aligning potential transactions against the Impact Management Project’s (IMP) category of ‘growing new or undersupplied capital markets’. Such businesses are often overlooked, with funding requirements too small to access the largest institutional direct lending vehicles. Importantly, we are not just addressing this structural aspect – as a sole lender to a business with these funding requirements, our relationship with the borrower is that of a key stakeholder which allows for successful collaborative engagement. From an impact perspective, if we are providing the entire loan, we can be more certain that it is our capital driving outcomes in a catalytic way. In our view, for broadly syndicated transactions or public bonds the link between investment and outcomes become more tenuous and, often, overstated.

Sectors; as one moves to a proactive positive screening approach, there is a natural focus on allocating to SDG-aligned sectors. Underpinning these sector allocations that seek specific outcomes is developing a theory of change which aims to link these desired outcomes to how they are practically achieved. By seeking to deliver targeted impact objectives and outcomes, a focused-sector approach really motivates the lender to go looking to positively allocate capital. This is completely different to that of negative screening, and changes the investment manager’s mindset from a static approach that is purely defensive in nature (precluding investments which do not meet the Responsible Investment policy from entering the portfolio) to that of an enabler, where the lender seeks to proactively allocate capital into specific types of businesses or sectors.

Sustainability; this encompasses the borrower engagement and the ability to write coupons that are linked to the achievement of certain outcomes. In the public markets arena, sustainability-linked coupons have rightly been widely derided for their lack of imagination in driving real borrower progress by the selection of easy-to-achieve or meaningless targets, and also the lack of incentivization with relatively small coupon steps; often it can be a mere few basis points. Within our loans we seek to have comprehensive borrower engagement that drives a real understanding of the ESG and impact baseline of the borrower, so that sensible targets can be structured with meaningful rewards for achieving targeted outcomes. At a minimum we would target a 25bp coupon step down for achieving outcomes linked to pre-agreed sustainability targets.

At RM we have formulated a scoring framework that encapsulates the above, to enhance the screening of potential transactions. Our intention has been to align this with industry-recognized impact standards where possible, and to embrace an open-book approach where others can adopt this framework or evolve it as they see fit, so that knowledge sharing and transfer can move the discussion forward on impact lending.

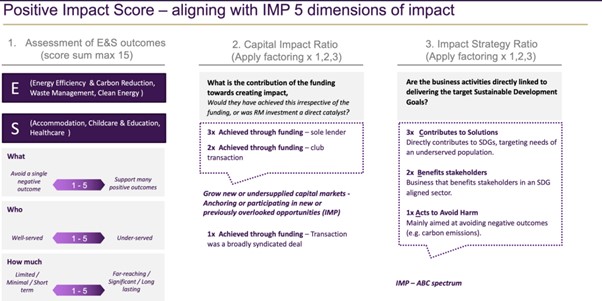

The Positive Impact Score methodology which RM have formulated, shown below, aims to establish a cumulative assessment of the borrower’s environmental and social outcomes across ‘What’, ’Who’ & ‘How Much’ (3 of the 5 dimensions of impact under IMP’s framework), with a score out of 5 for each, with factoring applied that captures a) lender contribution to impact creation (Capital Impact Ratio) and b) borrower impact intentionality across IMP’s ABC spectrum (Impact Strategy Ratio).

This allows the lender to screen out transactions that fail to meet a minimum threshold, and to monitor investee company progress during the investment period itself. Scores above the minimum threshold form part of our investable universe, with the focus then on identifying the impact roadmap RM can define for potential borrowers, and how these Positive Impact Scores can be lifted over time. Additional rigour is brought to the process by partnering with an impact assurance and reporting partner, which in RM Funds’ case is The Good Economy, to deliver independent impact assurance and investor reporting through an annual impact report.

In summary, RM Funds strongly believe that we can invest private debt capital to drive impact and report back to our investors and stakeholders on the impact that this capital has made through our impact measurement and management framework, including the scoring methodology described above. It also seems clear to us that, whilst impact means different things to different investors, the overall adoption and desire by investors to make impactful investments is growing from a small base and should in time form a strategy that sits alongside now mainstream strategies such as ESG. The debate and discussion as to how large impact can grow as part of investor’s allocations is a discussion for another article.